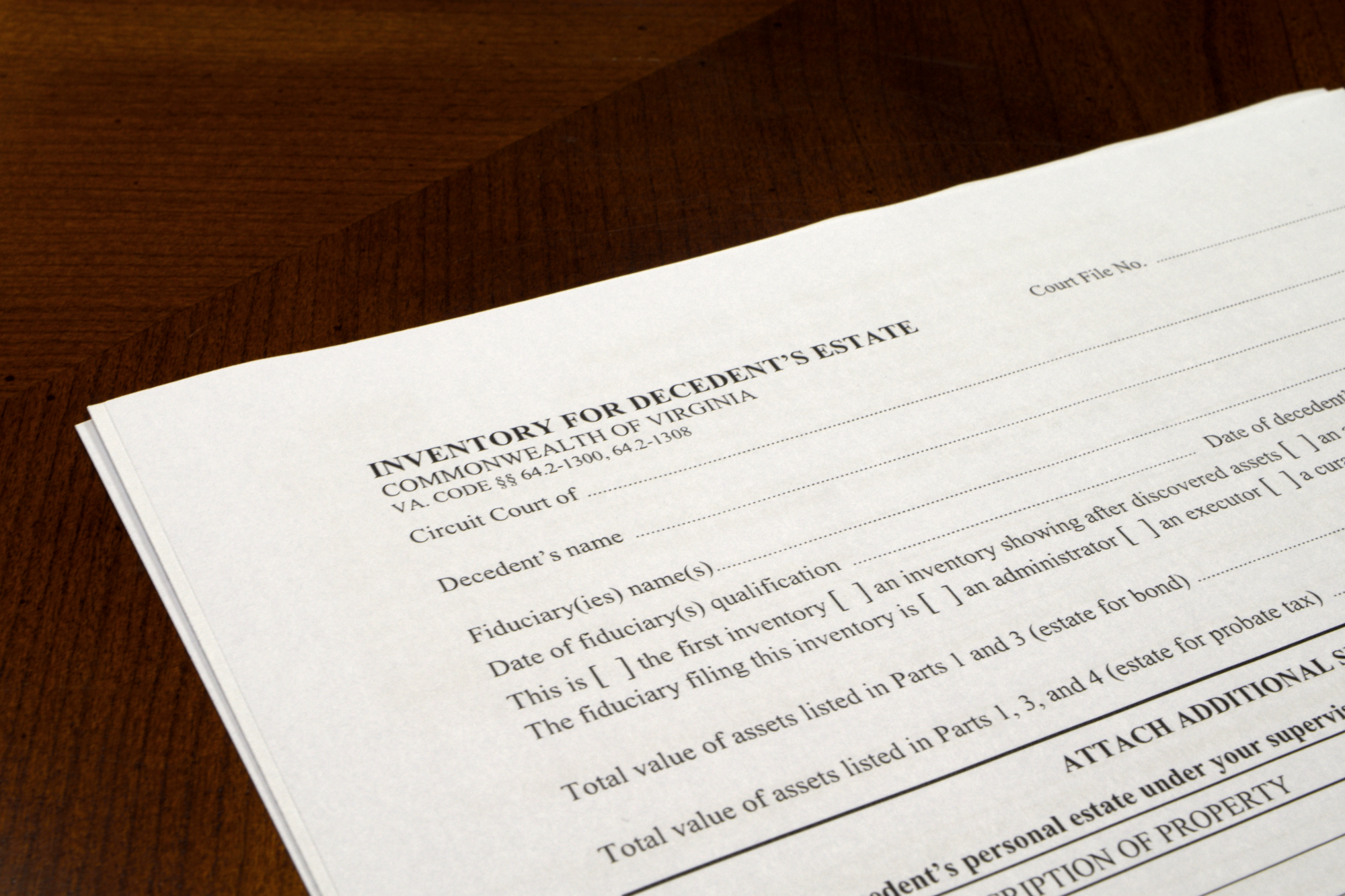

Pictured: An inventory form (Form CC-1670), which is one of the many forms that you will have to file with the circuit court if you administer an estate in Virginia. Let our skilled estate administration lawyers guide you through the probate process.

Let the Probate Lawyers at Hawthorne & Hawthorne Guide You in Your Time of Need

Losing a loved one can be a very difficult time in and of itself. Navigating the probate process can prove even more daunting, especially if you have never done it before.

You don’t have to go it alone.

The experienced probate lawyers at Hawthorne & Hawthorne are here to help make sure that this difficult time does not become more complicated than it has to be. Our skilled lawyers are able to guide you every step of the way.

Probating the Will and Qualifying as Executor or Administrator

If your loved one died with a will, then the will must be probated with the Clerk of the Circuit Court of the city or county where your loved one was residing at the time of death. We will prepare the necessary documents to probate the will, such as the probate information form (Form CC-1650), list of heirs (Form CC-1611), probate tax return (Form CC-1651), and other necessary forms in order to make this process go as smoothly as possible. And we will even send one of our attorneys with you on the day that you meet with the Clerk to probate the will.

If your loved one died without a will, in some cases an administrator is still needed to qualify to handle the estate. We will help you figure out if it is necessary to qualify as an administrator. If it is necessary, we will help you determine who can be the administrator and prepare any documents needed for the administrator to qualify with the Clerk.

In either case, after probating the will or qualifying as executor or administrator, you will need to mail notices of qualification or probate (Form CC-1616) to the family members and other beneficiaries named in the will. You will then need to file an affidavit stating that you have sent these notices (Form CC-1617) with the Clerk of Court. Our probate lawyers are able to assist you with sending these notices and filing the affidavit.

Administering the Estate

The probate attorneys at Hawthorne & Hawthorne are also here to guide you in the steps that you will need to take to handle the estate after probating the will and qualifying as executor or administrator. We are pleased to help with the following:

- We can help you open a separate checking account for the estate. You cannot simply receive estate assets and pay for estate expenses out of your own personal bank account.

- We will help you obtain a separate tax identification number (“TIN”) for the estate. Your loved one’s Social Security number can no longer be used after his or her death.

- We will help you determine how the estate’s assets should be distributed to the heirs or other beneficiaries. The law specifies how the estate’s assets should be distributed, even if there was no will.

- We will advise you how to respond if you receive a claim for statutory allowances or a claim for an elective share. Both a claim for statutory allowances and a claim for an elective share are ways to prevent a surviving spouse from being disinherited. Surviving minor children may also claim the statutory allowances in certain circumstances.

- We will show you how to maintain detailed records for each transaction involving the estate’s assets. This is important for when you have to file inventories and accountings with the Commissioner of Accounts.

- We will help you prepare and file the inventory with the Commissioner of Accounts. The inventory (Form CC-1670) is a document that lists all probate assets at their date-of-death value. It must be filed with the Commissioner of Accounts within four (4) months of the date on which the executor or administrator qualified with the Clerk of Court.

- We will help you prepare and file the annual accountings with the Commissioner of Accounts. An accounting (Form CC-1680) is a document that lists and itemizes all transactions that you have made as executor or administrator, and it allows the Commissioner of Accounts to perform a desk audit of your actions as executor or administrator. The first accounting is due sixteen (16) months after the executor’s or administrator’s qualification. Once you file the first accounting, if there are still assets in the estate, subsequent accountings will need to be filed annually until there are no longer assets in the estate (with certain exceptions). Filing the accountings has proven to be a daunting task for many people—but remember that our probate lawyers are there to help you every step of the way.

Small Estate Act

If the estate is what is known as a “small estate,” then the appointment and qualification of an executor or administrator might not be required. In order for the estate to be considered a small estate, all of the personal property in the estate must have a value at the date of death of less than $50,000.00. Our estate lawyers are able to help you determine if the estate qualifies as a small estate and can prepare all necessary documents required to transfer the personal property to the appropriate beneficiaries.

Contact One of Our Estate Lawyers Today!

Losing a loved one is never easy; trying to navigate the probate process alone will only make it harder. Our probate lawyers are available to help clients with administering estates throughout Southside Virginia, including estates in Amelia County, Appomattox County, Buckingham County, Brunswick County, Campbell County, Charlotte County, Cumberland County, Dinwiddie County, Halifax County, Lunenburg County, Mecklenburg County, Nottoway County, and Prince Edward County. If you need help administering an estate, contact one of our experienced probate attorneys without delay!